Graphite Electrode future trends are being driven by technological progress, sustainability, and shifting industry needs. These changes are impacting production methods, materials and applications. This market is also influenced by the changes in steel manufacturing, increased demand for lithium-ion battery technology, and energy efficiency.

The Graphite Electrode Market is segmented by product type, purity level, and application. The EAF sector is the market leader, and it's expected to continue growing in the forecast period due to the increased use of electric arc forging furnaces. The Basic Oxygen Furnace (BOF) segment is also growing rapidly, boosted by planned developments in secondary steel refining. The majority of BOF facilities are located in Asia. India’s plan to add 80 million tons of additional steel production using the BF–BOF process has driven growth in this industry.

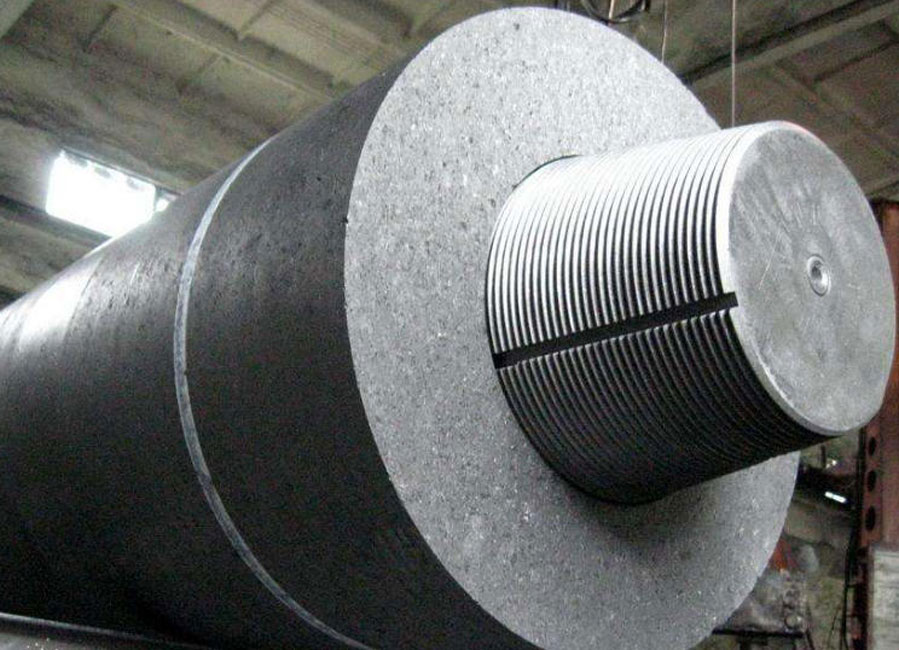

HPGE is the second most popular electrode and will continue to grow rapidly. HPGE, with its superior electrical and thermal properties, is mainly used in EAFs to melt scrap metal. This reduces power consumption while improving steel production. HPGE's market is also supported by a growing demand for high performance battery applications, such as Li-ion. HPGE's increased stability increases cell performance and durability.

Natural graphite's use is increasing, which reduces the carbon footprint of the product and its environmental impact. The mining of natural graphite has a lower risk than the extraction and use of synthetic alternatives, which involve high-temperature processes releasing toxic dust into atmosphere.

Major players on the Graphite Electrode Market engage in strategic initiatives that help them maintain and improve their market positions. These include R&D investments, R&D expansions, and alliances. These efforts should lead to greater profitability and access to the market.

Prices of essential raw materials for manufacturing such as needle coke and petroleum coke also affect the market. Prices of these commodities are volatile, which can impact production costs and cause fluctuating prices. The market is moderately concentrated, with several large Chinese firms (including Showa Denko SGL Carbon and GrafTech International), supplying the domestic market and exporting worldwide. Indian producers including SEC Carbon, HEG Graphite India and HEG's Graphite India have also been major regional suppliers. Other small manufacturers, located in North America and Europe, supply local steel industries and/or sell through online channels. To stay on top of the game, these producers also pursue new technologies and partnerships. Battrion AG and Jagenberg Converting Solutions GmbH launched a manufacturing technology to enhance the microstructures of negative electrodes for lithium-ion cells. This allows faster charging and discharging. This could significantly improve battery performance and increase energy storage capabilities without requiring significant adjustments to existing cell designs.

Write a Message